With the passage of the One Big Beautiful Bill Act (OBBBA), several key changes to the U.S. Internal Revenue Code are reshaping how manufacturers approach capital investment, tax planning, and overall growth strategy.

The OBBBA altered many business provisions critical for manufacturing investment, particularly those reinstating 100 percent bonus depreciation and creating a new expensing provision for manufacturing facilities. While these changes may benefit manufacturers from a tax liability standpoint, navigating them may present a challenge.

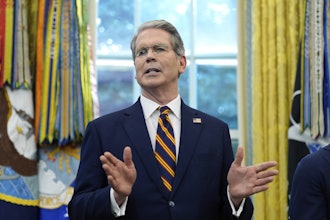

Now more than ever, manufacturing leaders must work with their tax teams to understand the implications of these provisions and plan accordingly. Manufacturers are already putting this collaboration into effect: 88 percent of respondents to the 2025 BDO Tax Strategist Survey indicated that the tax function is increasingly part of their strategic conversations.

How OBBBA Tax Provisions May Impact Manufacturing

Under Section 168(k), the OBBBA permanently restores 100 percent bonus depreciation for property acquired after January 19, 2025, unless the acquisition was subject to a prior binding written contract. This provision will generally allow manufacturers to once again immediately expense the full cost of capital investment in manufacturing equipment.

The legislation also creates a new elective 100 percent depreciation allowance for buildings and building improvements at manufacturing facilities. The new provision under Section 168(n) is available for any portion of nonresidential real property that is considered “qualified production property,” wherein construction on the property begins after January 19, 2025, and before January 1, 2029, and the property is placed in service by the end of 2030.

Qualified production property must be used in a qualified production activity, which includes the manufacturing of tangible personal property, agricultural production, chemical production, or refining. Manufacturers must carve out “any portion of building property that is used for offices, administrative services, lodging, parking, sales activities, research activities, software engineering activities, or other functions unrelated to qualified production activities.”

For smaller manufacturers, Section 179 allows businesses to immediately expense the full cost of qualifying equipment, software, and certain improvements to nonresidential property. The OBBBA increases Section 179 expensing limits to $2.5 million, with a phaseout threshold of $4 million for property placed in service after 2024, and both thresholds indexed for future inflation.

All three provisions are elective, and manufacturers can elect out of bonus depreciation on a class-by-class basis. In some circumstances, it may be more beneficial to postpone deductions due to interactions with other calculations, and modeling the impact of various scenarios will be important.

Manufacturers that take advantage of these provisions may see a cash flow benefit they can use to pay down debts while interest rates are high or hold onto cash to prepare for action when the business outlook improves. Businesses should also consider the impact of the provisions when deciding where to invest capital and source new manufacturing activity.

The Interplay Between Tax and Business Decisions

Businesses should select which provisions to take advantage of based on what they qualify for and how those provisions fit into their long-term strategic plans. These decisions necessitate close engagement with the tax function because every decision has tax implications that may impact manufacturers’ broader business strategies.

The definition of qualified production activities will be important for the new category of expensing under Section 168(n). Qualified production will require substantial transformation of the property comprising the product, but the definition of “substantial transformation” requires more guidance from the IRS. Manufacturers and their tax teams should look to similar IRS rules for guidance as they await clarification.

Manufacturers planning to take advantage of Section 168(n) should consider performing cost segregation studies to verify which expenses will qualify, particularly if their buildings serve more than one function, such as office administration and sales. Tax teams can identify which activities and facility areas qualify, potentially applying these provisions to additions or improvements to existing properties that meet regulatory requirements.

As manufacturers prepare for these changes, they may also consider establishing a permanent place for tax leaders on strategic planning committees. Manufacturers can better avoid risks and build resilience when they understand the implications of tax decisions before they are made, rather than bringing the tax function in after the fact to remedy the issue. The tax team’s involvement may include:

- Hosting capital allocation meetings to model the immediate effects of 100% expensing on equipment purchases.

- Aligning construction dates with Section 168(n) requirements.

- Coordinating when property is placed in service to qualify for the 100 percent bonus depreciation benefits under Section 168(k).

- Tax leaders can also help model the interaction with other important tax calculations, including the reinstatement of research and development expensing and changes to international provisions.

Seventy-three percent of leaders surveyed in BDO’s 2025 Techtonic States Report agree: To succeed in a highly uncertain and volatile operating landscape, organizations must prepare for a range of potential futures.

Although tax policy is evolving quickly, manufacturers that engage the tax function in strategic planning now will be better prepared to adapt and position their businesses for growth despite turbulent economic times.