The global market demand for lithium-ion batteries is skyrocketing. The entire battery supply chain — from mining and processing raw materials through battery manufacturing and finally to recycling — is scrambling to catch up to exponential growth in demand.

Electrification in general, and the battery market, in particular, is often compared to epic proportions of the California Gold Rush. An important difference is that gold production peaked in 1852, just three years after the mass migration of the 49ers. The Battery Boom, on the other hand, will continue its rapid growth well into the future.

Exponential Growth in Demand for Batteries

The McKinsey Battery Insights team forecasts that the global lithium battery value chain could grow by over 30% annually from 2022 to 2030, reaching a value of more than $400 billion and a market size of 4,700 gigawatt-hours (GWh). Even these projections may prove to be too low, according to McKinsey, because “battery demand forecasts typically underestimate the market size and are regularly corrected upwards.”

Electric vehicles will account for most of this demand, but stationary Battery Energy Storage Systems (BESS) are also projected to grow at a CAGR of 30% from 2023-2033 according to IDTechEx, reaching 2,000 GWh of cumulative stationary storage capacity within ten years. Among the many applications of BESS are systems that balance the intermittent energy generated by solar and wind and residential, industrial and utility-scale systems that provide backup power during grid outages.

The Gigafactory Economy

A gigafactory economy has rapidly emerged to meet the demand. In the U.S. alone, Atlas Public Policy counted $73 billion in investments into massive-scale battery and EV plants announced during 2022, more than three times the previous record, set in 2021.

Giga means giant in ancient Greek. The term gigafactory was first used by Elon Musk in 2013 to denote billions of watt-hours of annual production capacity. Battery factories as large as 50 GWh are coming online in 2023 with planned future extensions up to 200 GWh.

Scarce Raw Materials

All this battery manufacturing depends on the availability and price of raw materials, and securing future supply is a top priority for automakers and governments.

Fifty years ago, most of the world’s lithium supply came from North Carolina, but the U.S. has become a net importer of critical minerals used in batteries. Atlas reports that 2021 imports represented 25% of the lithium consumed, 48% of the nickel, 76% of the cobalt, and all the graphite and manganese. China now dominates the processing of lithium, nickel, manganese, cobalt and natural and synthetic graphite, accounting for 40-80% or more of the global capacity of these critical materials.

The White House explained in 2022: “Critical minerals provide the building blocks for many modern technologies and are essential to our national security and economic prosperity.… As the world transitions to a clean energy economy, global demand for these critical minerals is set to skyrocket by 400-600% over the next several decades, and, for minerals such as lithium and graphite used in electric vehicle (EV) batteries, demand will increase by even more — as much as 4,000%.”

Securing Raw Materials

Lithium is sometimes mistakenly understood as scarce in the U.S. In fact, 12 million tons of identified lithium resources have been found in continental brines, claystone, geothermal brines, hectorite, oilfield brines and pegmatites, totaling one-eighth of the world’s resources, according to the U.S. Geological Survey. This represents the largest deposits of the metal outside of the so-called Lithium Triangle region in South America and is almost double the deposits in China.

These figures are “identified resources” which the U.S.G.A. defines as deposits for which location, grade, quality and quantity are known or estimated from specific geologic evidence but may or may not be extracted economically using current methods.

“Reserves” are the subset of these deposits that can currently be economically extracted, whether or not extraction facilities are in place. Using this definition, 4% of the world's lithium reserves are located in the states of Nevada, North Carolina and California.

Recategorizing deposits from “resources” to “reserves” involves economic considerations, politics and research and development. Typically, lithium is either extracted from rock mining operations or recovered from evaporation ponds, processes that can be destructive to the environment and harmful to the local communities.

EnergySource Minerals is building a plant at the Salton Sea in California that would extract lithium from the brine brought to the surface by geothermal power plants. The company’s CEO told 60 Minutes that it will be the cleanest, most efficient lithium process in the world, producing more than 300,000 tons a year.

Government Incentives

To accelerate domestic production, the Trump administration advocated the deregulation of the mining industry to fast-track domestic projects, and the Biden administration has invoked the Cold War-era Defense Production Act to enable the federal government to support the development of mining and processing operations.

In the National Blueprint for Lithium Batteries, issued by a consortium that includes the U.S. Departments of Energy, Defense, Commerce and State, established four goals, covering the four components of the lithium battery supply chain:

- Goal 1: Secure access to raw and refined materials and discover alternatives for critical minerals.

- Goal 2: Support the growth of a U.S. materials-processing base able to meet domestic battery manufacturing demand.

- Goal 3: Stimulate the U.S. electrode, cell and pack manufacturing sectors.

- Goal 4: Enable U.S. end-of-life reuse and critical materials recycling at scale.

To supercharge these efforts, the Inflation Reduction Act (IRA), passed in August 2022, includes $370 billion in tax credits for initiatives across the entire battery value chain. By the end of 2022, the IRA already incentivized new investments of $5.4 billion in mining and processing critical materials, $16.6 in battery manufacturing, $2.2 billion in EV. Manufacturing, and $3.5 billion in battery recycling, according to BloombergNEF.

Ramping Up Production

Ramping up production at this rapid pace and at enormous scale is difficult and risky at every component of the lithium battery supply chain. These challenges would be significant for a mature industry, but the battery market is evolving and changing, with technological innovations as well as economic and political developments. The Covid-19 pandemic and the Russian-Ukraine war are examples of unforeseen events that cause disruptions in the already vulnerable supply chain.

In March 2023, Automotive World detailed 43 U.S. and Canadian lithium battery factories with a total of 60 GWh of existing capacity and announcements of 750 GWh by 2030, with possible extensions up to 1,400 GWh.

However, it warned that “not all of these will materialize due to missing operational experience, availability of production equipment, scarcity of talent, lack of secured sales volumes/anchor clients, supply constraints for critical materials and financing challenges.”

The Equipment Supply Shortage

In a January 2023 article, “Battery 2030: Resilient, Sustainable and Circular,” McKinsey places equipment shortages as first among the list of obstacles: “Shortages of manufacturing equipment, construction material and the skilled labor required to ramp up production are a few reasons why many battery-cell factories experience significant delays.”

In another article, about the European market that also applies to North America, McKinsey reports that “Today, only a handful of companies that specialize in battery cell manufacturing equipment—used for slurry mixing, electrode manufacturing, cell assembly and cell finishing—are operating in Europe.... As a result, European battery cell manufacturing companies and EV OEMs who enter the field are likely to face a bottleneck in equipment supply that will place their planned start of production at risk. Securing equipment supply is a key success factor.”

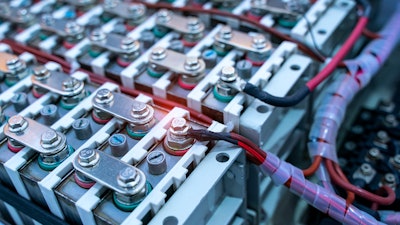

Pumps are Critical Manufacturing Technology

No equipment is more crucial than pumping technology in keeping the lithium battery supply chain flowing. Lithium is among the most challenging media for pumping applications in the chemical sector.

The light metal does not occur freely in nature due to its high reactivity. Pumps must be able to handle the chemically complex lithium slurries, which are highly flammable, very abrasive, have high amounts of solids and can contain a wide variety of other metals, graphite, solvents, binders, alcohols and acids. And the manufacturing processes require the pumps to convey these challenging viscous slurries without pulsations or pressure fluctuations, and often at very low flow rates, to ensure optimum battery cell production quality.

Pump designs, materials of construction and surface finishes must be engineered to prevent contamination of the media — which could degrade battery quality and performance and increase the risk of thermal runaway fires —and to facilitate easy and effective pump cleaning.

During slurry preparation mixing and electrode coating operations, pumps must also precisely dose and meter a wide variety of active materials and battery chemistry slurries, in addition to accurately dispensing the other battery cell production fluids; electrolytes, adhesives and UV resins.

Progressing Cavity Pumps

One type of pumping technology, progressing cavity pumps, has proven especially effective at meeting all these criteria with the versatility to excel at the many different pumping applications in the battery production and recycling processes.

Progressing cavity pumps belong to the category of positive displacement pumps, which work by trapping a fixed amount of fluid in multiple cavities and “progressing” or moving them through the pump during operation. Positive displacement pumps are commonly used in applications that require a constant and steady flow rate and frequently on products having high percentages of solids and abrasives.

In addition to progressing cavity pumps, which have been used for years, two other types of positive displacement pumps, rotary lobe pumps and peristaltic pumps, are well-suited for a more limited range of lithium battery applications.

Pumping Safely and Efficiently

The main design feature of progressing cavity pumps is the eccentric screw principle in which a spiral rotor rotates inside a geometrically matched stator. Since the shape of the cavities between the rotor and stator is always constant, the uniform delivery cavities gently move the product continuously and consistently from the pump suction inlet to the pump discharge, at a constant discharge rate free of flow pulsation. Liquids, solids and viscous slurries can all be conveyed safely and efficiently, and the flow rate can be precisely controlled for fluid measurement and metering, which is directly proportional to the shaft speed.

One of the essential benefits of progressing cavity pumps is they can be designed to eliminate direct metal contact between the wearing pump components and the pumped product so that no worn metal particles contaminate the process fluids. An extremely important requirement for battery cell manufacturing to reduce the risk of electrical shorts.

Another advantage of progressing cavity pumps is their versatility and adaptability. The NETZSCH NEMO Progressing Cavity Pumps, for example, have been tailored to solve a very wide range of lithium battery pumping applications in China and throughout Asia, Europe and North and South America.

With four different helical rotor and stator geometries, and a variety of engineered flexible shaft joints, along with an extensive selection of shaft sealing and material of construction options, NETZSCH specialists can apply their battery industry expertise to select the right pump for each application.

- Raw Material Extraction. For decades, progressing cavity pumps have proven to be powerful and reliable for the extraction of lithium and other minerals. They are well-suited to the challenges of conveying highly viscous slurry and liquids with high solids content, over a long period, with minimal wear and tear.

- Wet Grinding. The wet grinding process that produces the very fine raw material particles, requires abrasion resistant pumps to convey these slurries. Despite the extremely high abrasiveness, progressing cavity pumps offer a longer service life than other pump technologies. The NEMO pumps feature an innovative FSIP design (full service-in-place) that saves up to 66% in maintenance time and reduces downtime.

- Metering and Mixing. Pumps also play a key role during the mixing process of the precursor products (pCAM) and cathode active material (CAM) products in battery manufacturing. The various metal oxides must be accurately metered and homogeneously mixed to ensure consistent and effective battery performance. Progressing cavity pumps provide high metering accuracy, as well as high corrosion resistance and, thus, low maintenance costs and long service lives.

- Coating Process. The critical step in battery manufacturing is the coating process which involves the pumping of electrode slurries on to the current collector foils. The coating slurry, which can be a highly viscous needs to be fed with minimum pulsation and maximum precision to the coating system to create a thin and uniform coating thickness on the foils to meet ever tighter manufacturing tolerances.

- Recycling. Lithium-ion battery recycling operations are developing and growing as fast as the initial battery manufacturing plants are. However the recycling pump applications are even more challenging than the initial battery production, containing a very wide variety of chemicals, solvents, metals, ceramics, plastics and other abrasive solids. Yet progressing cavity pumps are ideally suited and used for these harsh pumping services.

Keeping the Battery Supply Chain Flowing

To use a metaphor from the internal combustion engine, if electrification is to overtake fossil fuels in time to stave off the worse effects of climate change, the battery supply chain must continue to be firing on all cylinders. That means all components of the supply chain must continue to keep pace with each other. Progressing cavity pumps are a critical manufacturing technology to keep the entire process moving forward.