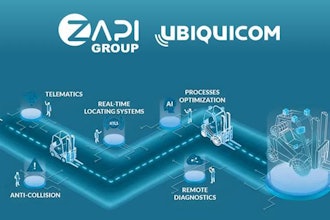

Moving forward, Environmental, Social and Governance reporting is going to impact your material handling equipment buying process.

Purchasing forklifts is no longer just about comparison-shopping for the best products, adding an item to the expense column of your ledgers and creating processes for the ongoing monitoring, managing and maintenance of said machinery. With climate change becoming a focal point across industries, ESG strategy requirements are only going to play a bigger role in how you choose forklifts.

ESG reporting may require that, as a material handling equipment (MHE) provider or user, you must be prepared to discuss carbon footprint, energy efficiency, waste and recycling with your customers. You must provide relevant data as part of the sales and contracting process.

Carbon emissions must be tracked with accuracy and that means understanding the different types of emissions, which are classified as Scope 1, Scope 2 and Scope 3. These are defined as follows:

- Scope 1 – direct emissions of resources you own or control. Example: a food and beverage manufacturer uses its own fleet of trucks. Their emissions are Scope 1.

- Scope 2 – indirect emissions from purchased or acquired energy. Example: A/C and heating in a manufacturing facility are powered with electricity provided by a utility burning coal. Its emissions are Scope 2.

- Scope 3 – indirect value chain emissions, stemming from activity conducted by assets not controlled by the reporting entity. Example: the forklifts used in a warehouse or a distribution center by a 3PL partner of a food and beverage company. Their emissions are Scope 3.

Key developments in ESG regulations in 2022

Pending challenges or action via Congress, new ESG regulations are to go into effect as early as December 2022. Here are the key developments you must be mindful of.

SEC proposes climate-change-related disclosure rules

The SEC’s climate-change disclosure rules are extensive. If adopted, reporting companies would be required to make disclosures in registration statements and annual reports regarding their climate change risks. There are three dates you should be aware of:

- You can expect the rule finalized and formalized legal guidance communicated by December 2022.

- If there are no legal actions or challenges taken by congress, the new climate change requirements will take effect. Larger accelerated filer organizations will need to track their 2023 ESG strategy, risk and performance to prepare for their SEC reporting.

- By 2024, qualifying businesses will be required to disclose SEC 2024 reporting based on the first set of climate disclosure standards for their 2023 financial year.

Third-party assurance/audit of ESG reporting

Third-party assurance of reporting is gaining traction. Companies engaging in ESG reporting should consider assistance when reporting, given that legal and litigation risks for inaccuracies and fund labeling are increasing.

It’s less costly and less troublesome to get everything done right the first time around than to have to do it over and end up paying fines. This goes hand in hand with the next point.

Legal & litigation risk for inaccuracies in how you’re labeling your company’s spending

Given the risk, reporting companies must increase due diligence. These requirements aren’t going away, so you must make ESG reporting a part of your overall strategy. Regular, consistent and ongoing tracking of required criteria ensures better results.

What are the benefits of ESG reporting for private companies?

From customer retention and recruitment to the strengthening of partnerships, ESG reporting has already been shown to produce significant benefits for organizations.

So, while the requirements may seem overwhelming, in the grand scheme of business operations and expansion, it’s well worth following and implementing necessary systems and procedural infrastructures. Here are three key opportunities well worth mentioning:

Switching to more efficient “green” solutions, like lithium batteries

Switching from standard battery solutions to lithium batteries may seem like a small, insignificant transition, but even the World Economic Forum believes strongly in the idea that advanced batteries are a key part of the energy transition and will have a far-reaching impact on climate change initiatives.

Lithium-ion forklift batteries have several advantages, including:

- High energy density and high energy conversion efficiency

- Long cycle life

- Safer solution

- Better shelf life

- Absence of health hazards

- Stable performance under extreme temperature conditions

- And more

Less energy consumption, longer life and low maintenance requirements mean cost savings. Cost savings mean improved profit.

Investor relations

Organizations looking to secure future funding should make ESG reporting a high priority. The investor of tomorrow is more environmentally conscious and climate change focused than the investor of yesteryear and they will be investigating whether companies check certain climate change boxes before further engaging with them.

Securing your company’s future could be contingent on investor relations and investor relations will improve with properly monitored and audited green initiatives.

Some risks of failing to understand and adapt to ESG could include a lower valuation of the company, falling behind peers and competitors, declining attractiveness to employees (see the next section), higher insurance premiums, lower earnings, fines from non-compliance and more.

Employer attractiveness

There are many factors that matter to today’s workforce, but Gallup says 42% of employees value an organization that’s diverse and is inclusive to all types of people.

Prospective employees will not only be looking for career opportunities with growth as a focus, but they will also be looking for compliance and adherence to ESG activity. Finding the right talent could very much be affected by your attention to ESG in the months and years to come.

Sustainable procurement barometer 2021

In collaboration with the Value Chain Innovation Initiative at the Stanford Graduate School of Business, in July 2021, EcoVadis published the Sustainable Procurement Barometer 2021, a document covering insights into sustainable procurement. Here are some of the major takeaways from this document:

- Procurement strategy is driven by labor and human rights issues, environmental considerations, social issues and business ethics, in that order.

- 61% of procurement leaders suggest social issues will be a critical part of their strategy in the next two to three years.

- 71% of suppliers and 63% of corporations say their sustainable procurement initiative helped them navigate and survive the COVID-19 pandemic.

- Sustainability performance is now considered by 69% of survey respondents when renewing contracts or selecting new suppliers.

- 48% of mid-sized companies believe sustainability initiatives will have a positive financial impact on their business and 47% believe it will lead to streamlining costs and better operational efficiency.

Core elements of ESG strategy & reporting of corporate customers

There are many aspects to understand when it comes to ESG strategy and reporting. There would be no practical means of covering it all here, so additional self-study is recommended. What follows is a broad overview of ESG, what they mean and some of the reporting criteria.

Environmental

The E in ESG refers to environmental criteria, the energy you take in as well as the waste you generate, the resources required, carbon emissions and climate change. These are guided by the fundamental principle that every company affects and is affected by, the environment.

Greenhouse gasses (GHG), including the aforementioned Scope 1, 2 and 3 carbon emissions, are central to key reporting frameworks like CDP (formerly Carbon Disclosure Project) and Global Reporting Initiative (GRI).

The reduction of hazardous waste is also a key component of environmental criteria. For more, refer to the section on “green” solutions like lithium batteries in this article.

Social

S stands for social criteria. The focus here is on inclusion and diversity, the relationship you have with your employees and the community and institutions you do business with. As with environmental criteria, the idea is that companies live in an ecosystem of diversity and should therefore value diversity in their personnel and company culture. Following the social criteria can boost a company’s reputation, better reflects the values of people at large and attracts better talent across different demographics.

Social reporting encompasses many criteria, including but not limited to:

- Human capital

- Health and safety

- Chemical safety

- Controversial sourcing

- Social opportunity

- Access to finance

- Access to healthcare

Governance

G is for governance, especially the procedures and processes you create for self-governance in carrying out ESG reporting and activity. It also encompasses the interests of stakeholders and compliance with the law. Every company is considered a legal creation and is therefore subject to governance.

Governance reporting encompasses many criteria, including but not limited to:

- Corporate governance

- Board diversity

- Executive pay

- Ownership

- Accounting

- Business ethics

- Corruption and instability

- Tax transparency

What regulatory bodies are shaping ESG guidance & reporting standards?

Besides a clear understanding of ESG and everything it entails, an understanding of the regulatory bodies shaping the ESG Agenda of corporations will ensure a more comprehensive view of the issues.

The following regulatory bodies are responsible for shaping guidance and reporting standards:

- Sustainability Accounting Standards Board (SASB) International Sustainability Standards Board. Identified the most relevant environmental, social and governance issues pertinent to 77 different industries.

- Public Company Accounting Oversight Board (PCAOB) Standards and Emerging Issues Group. Establishes auditing and professional practice standards in preparing audit reports.

- American Institute of Certified Public Accountants (AICPA) Sustainability Assurance and Advisory Task Force. Currently in the process of updating the Guide: Attestation Engagements on Sustainability Information to include critical information on greenhouse gas emissions, as well as corporate social and environmental performance. It would be critical to keep an eye on future developments.

Conclusion

When buying equipment for your company or selling it to your customers, there are Environmental, Social and Governance considerations that must be taken into account.

As companies make strides towards adopting green initiatives and in a collective attempt to reduce the risks of climate change, there are extensive reporting requirements to follow and the need for third-party assurance to guarantee accuracy.

Decisions can no longer be made in isolation. They must be made with a more holistic picture of a company’s objectives, as well as ESG responsibilities and activity.

This helps you get more (often corporate) clients who are conscious about the environment and demand ESG reporting from their suppliers. The benefits of ESG reporting can be well worth investing in advanced material handling equipment.