How to radically improve the performance of your legacy spares planning system without buying a new one.

This article first appeared in IMPO's August 2013 issue.

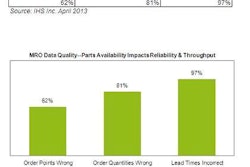

At one time or another, a maintenance organization has struggled with getting the best cost and service performance out of its spares inventory. Often, the penalties for not getting spares “right” are significant. And with the emergence of new service models such as “power by the hour,” providers are signing contracts that carry a hefty penalty for below-target performance.

But despite these factors, it’s extremely rare to find a maintenance organization demonstrating an advanced capability in spares optimization. That is especially true when the typical maintenance department is compared to their for-profit aftermarket brethren who have been running large-scale parts businesses for decades.

There are several contributing factors. One is the very nature of equipment maintenance. Randomized failures, sporadic demand, and bad data are common, all of which complicate traditional planning techniques and places the emphasis on agility and execution. Two, the criticality of needing high in-stock positions for critical spares oftentimes reduces the concept of planning to a simplistic “just cover the worst-case scenario with lots of inventory” approach. Three, some of the science of spares planning, such as probabilistic modeling and advanced statistics, is too difficult to sustain in many organizations. And last, with the potential cost of deploying best-of-breed planning solutions now approaching several million dollars, many organizations choose to stick with their legacy systems regardless of performance.

But there is a light is at the end of the tunnel: Specific analytic techniques and new processes can be used to significantly improve a legacy spares system’s performance. These changes can be made with a low-to-modest investment that is a fraction of the complexity of a new system install. Planners can conduct these analytics and determine how to merge them with their system, whether it’s updates to the planning parameters, refined algorithms, or to change the business rules in the software. Although parts planning requirements can vary business to business, Accenture has developed an analytic methodology that has helped many Accenture clients across industries significantly improve their spares systems without any new technology investment.

4 Steps For Improving Spare Systems

The figure below provides an overview of the overall four-step methodology:

In regards to the first step: At least two years of historical data at the stock keeping unit (SKU) level should be collected for the analytics. It should provide the monthly SKU-level usage by quantity and standard cost. Collecting additional SKU data, such as the storeroom location, minimum reorder quantity, and service impact code is also helpful. The data should be cleansed so that it is error-free.

The right sampling approach for the spares operation should be determined by the planner. If the network is too large to model the population of transactions (e.g., too many records), then a sample of SKUs that best represents the supply and demand dynamics of the population may be created.

In the second step, segmentation classes are developed to group SKUs based on their supply and demand characteristics. These segments can be used to create a differentiated service strategy and planning policies that use insightful criteria to identify unique, mutually exclusive parts classes that planners can use to optimize the cost and service dials of their inventory.

Getting the segments right is important, and there are guidelines to consider when creating segments. They should be mutually exclusive so that each is unique and distinct. They should be actionable, and you should avoid creating a large number of segments that become unwieldy or too difficult to implement.

In the third step, the data segments are aligned to a planning model. This simply means that a planner will match the degree of planning complexity exhibited by a SKU with the correct deployment and replenishment techniques. For example, the segment that we identified in the earlier figure called “Constant Review” would not be a good fit for using simplistic, time-based methods such as “weeks forward coverage” (WFC) for determining the coverage quantity.

In fact, “Constant Review” SKUs may never be candidates for traditional time series-based forecasting techniques. A reorder point (ROP) approach with an advanced statistical safety stock may be more suited for such a segment. And the analytics that developed the earlier segmentation model may show that “Constant Review” SKUs would be a fit only for an ROP model that used parameters that incorporated a Poisson or other non-normal demand pattern. Conducting the proper analytics and segmentation can help a planner map segments into the correct framework.

However, there are a few common mistakes to avoid in the fourth step when selecting a planning model. One is the use of the Economic Order Quantity (EOQ) for reorder lot size determination. EOQ is generally a poor fit for spares that have seasonal or declining demand profiles. They work best when there is a constant, annual demand. In fact, when using EOQ, planners are often given a reorder recommendation that is a multiple of the quantity that was consumed for the entire past year. The result: not only excess stock, but obsolescence charges and increased carrying costs.

But there are alternatives. One approach is to use Average Order Quantity (AOQ), which uses average consumption over a user-specified time period. Another is EOQ Cap (EOQ-C) that will apply the standard EOQ calculation but “cap” the output when it’s compared to a ceiling value, such as a percent of last year’s total demand.

Another mistake in selecting the planning model – perhaps the most detrimental mistake in spares planning – is assuming that a SKU exhibits normally distributed demand when it does not. Accenture’s experience has shown it’s common for 30 to 70 percent of the SKUs in a spares business will exhibit stochastic demand, which is demand that is truly randomized and can’t be estimated using traditional techniques. Most forms of time series forecasting are not effective with stochastic SKUs. Our modeling has shown that if a Poisson part is planned to have a 98 percent service level and it is used in conjunction with a conventional safety stock formula that isn’t adjusted to account for the randomness of a Poisson distribution, then that 98 percent fill rate will never be consistently realized. Bad behavior will result: Planners may over-order, and maintenance technicians are likely to hoard the part to account for the inconsistency.

Applying the Method

The solution is embedded in the methodology we’ve been reviewing. After conducting the segmentation analytics to identify the non-normally distributed parts and selecting the planning model, algorithms and parameters that complement the supply and demand complexities of that SKU and account for the underlying probability distribution should be created for each segment. It’s common to bring all this together in a framework called a “planning template.” And at this stage, the input of a resource skilled in operations research and statistical modeling is warranted.

The planning template should capture the major variables – target service level, network deployment location, safety stock calculation – and show the value for each variable in that segment. Pulled together, these planning templates become the master inventory planning playbook to guide policy implementation. An example is shown in the figure below.

To apply this method, our teams typically use spreadsheet and database tools to build a spares model for scenario analysis and to fine-tune the parameters to converge on the right combination that optimizes cost and service. Generally speaking, we use this approach to execute the methodology:

- Conduct offline modeling in a database tool to determine the optimum algorithms, business rules and parameters, and then overwrite these existing values in the legacy planning system to improve its performance.

- Identify the critical and hard-to-plan spares in the legacy system and optimize them in an offline tool more suited for their requirements, and allow the legacy system to continue to plan the easier and less critical SKUs.

The methodology is executed with a pilot using a sample that mirrors a set of SKUs being planned in the legacy system at the same time. The pilot establishes a performance baseline for both the sample and the legacy system on availability, turnover, and obsolescence metrics to compare relative performance and fine-tune the policies and parameters of the model to improve performance.

Some Accenture clients who have used this approach have improved their parts availability up to their target fill rates while also reducing their inventory and improving turnover. Over time, the mix and balance of the network is better aligned to actual demand. Additionally, our clients have realized the benefits with an investment that is much less than the cost of a new planning system. Clients also improve their own capabilities as a result of the knowledge sharing that occurs during the project, which contributes to their ability to sustain results into the future.

The end results should be what any maintenance organization strives for: extracting more value from existing assets, making the best use of scarce capital, and improving the organization’s talents and skills.

Robert Giacobbe is a Managing Director for Accenture and is the global lead for Accenture’s Service Strategy and Operations (SSO) consulting practice. Mr. Giacobbe works with clients in their service chain, aftermarket business, and maintenance organization to help them improve their operational and financial results. Accenture is a global management consulting, technology services, and outsourcing company.

This publication is intended for general informational purposes only and does not take into account the reader’s specific circumstances, and may not reflect the most current developments. Accenture disclaims, to the fullest extent permitted by applicable law, any and all liability for the accuracy and completeness of the information in this publication and for any acts or omissions made based on such information. Accenture does not provide legal, regulatory, audit, or tax advice. Readers are responsible for obtaining such advice from their own legal counsel or other licensed professionals.